Tesla is an American motor company that is powered by Silicon Valley to become one of the most dynamic automotive company in America and the world at large. Tesla is largely using alternative energy such as solar to power their cars. They also produce hybrid vehicles and battery-powered cars. As a pioneer of sustainable energy option, Tesla is covered by a strong research and development team of engineers. Due to using alternative energy options in powering their cars, Tesla is considered to be a benchmark in green technologies.

Founded by a team of engineers with the desire to break the conventional mindset that owning and driving electric cars required a compromise, the company has been credited with several firsts and has motivated several competitors to delve into new motor designs in the alternative energy arena. Tesla motors manufacture vehicle in almost all categories from hatchbacks, sedans to convertibles which run exclusively on alternative energy.

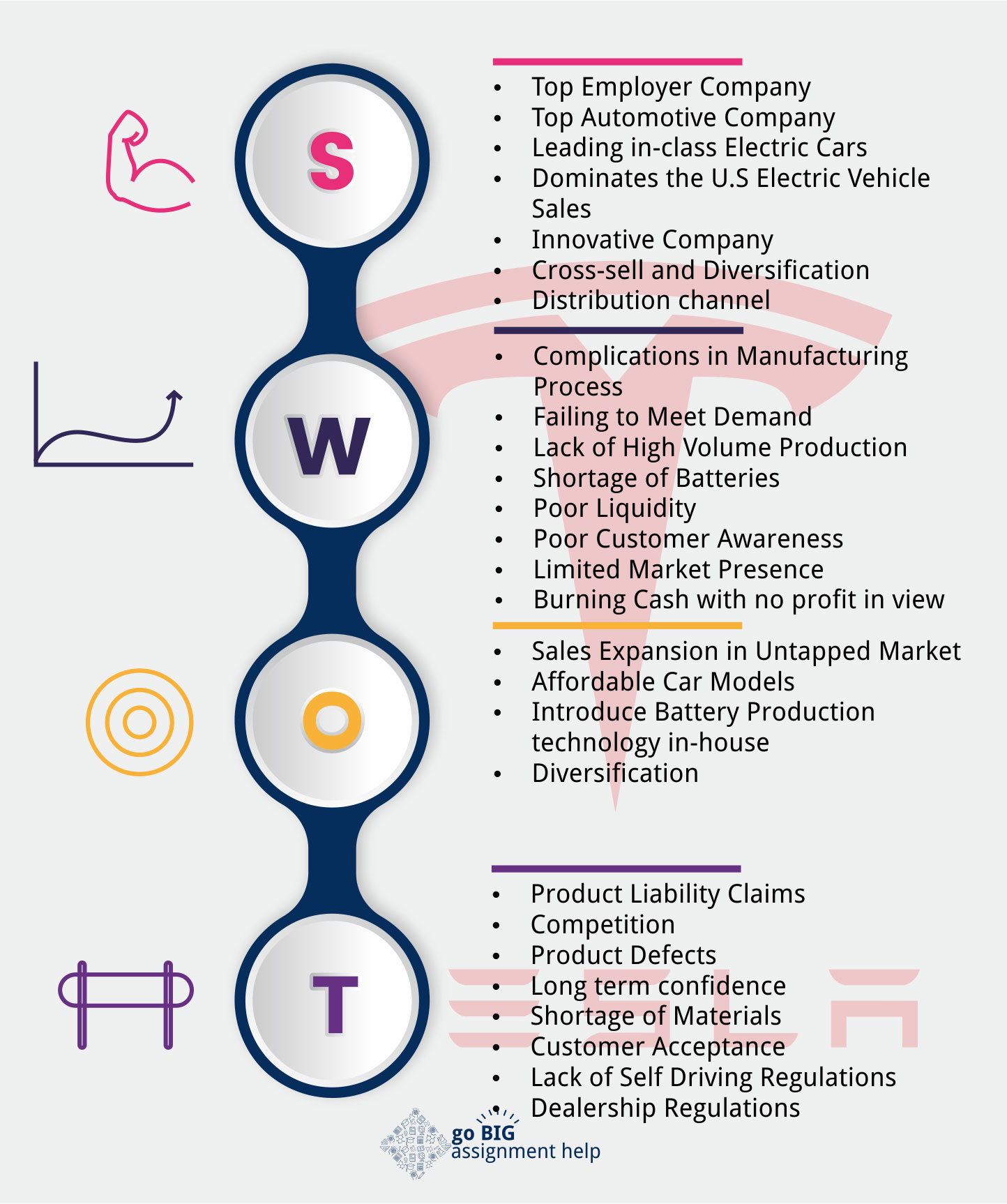

The use of alternative energy to run vehicles has made Tesla be one of the most discussed and analyzed motor companies among business pundits. This Tesla SWOT analysis will help reveal significant insights into every aspect of the Tesla business model. This analysis will include strengths, weaknesses, opportunities, and threats that Tesla faces in its operations.

Without much ado, let’s delve in and find out the factors that affect Tesla’s competitiveness in the global automotive markets.

On this page:

Tesla’ Strengths;

We can start with the strengths of Tesla Motor Company which will include the positive aspects that have overtime reinforced the position of Tesla in becoming the dominant motor company across the world. These are the factors we consider to be Tesla’s strengths and have ensured profitability, popularity, and expansion of the company in the long term.

- Top Employer Company

Any company is as good as it employs. This is one of the key factors that have catapulted Tesla to remarkable success heights. According to the Wall Street Journal reports, Tesla has emerged as an ideal company for employees owing to its diversity and innovation-encouraging culture. Most recently, it was listed as one of the leading companies to work while attracting young jobseekers with fresh untapped energy and talent. Besides, Tesla has been featured in Forbes as one of the best employers in 2019.

- Top Automotive Company

Despite being riddled with several legal issues, Tesla’s sales have always increased each year. This has made it the leading automotive brand for 2019 after delivering 90,000 vehicles in the last quarter of 2018. This included 63,150 Model 3, 13,500 Model S and 14,050 Model X vehicles. The high sales have largely been attributed to its unparalleled advancement in luxury and innovation. It is no doubt that Tesla has passed some exclusive automobile brands like BMW and Mercedes.

- Leading in-class Electric Cars

When it comes to producing the finest electric cars, Tesla has left major brands far behind. If you compare in terms of range, cars manufactured by Tesla have proved to be the best by covering maximum distances. For instance, in the recent comparison, Tesla occupies all the top three positions in terms of range. Tesla’s Model S will deliver you the furthest distance as it travels up to 600 kilometers on a single battery charge. Opel Ampera brand came close with 520 kilometres of range on a single charge.

- Dominates the U.S Electric Vehicle Sales

Statistics from Statista shows that Tesla’ Model 3 is the dominant electric car sold in 2019 with a sale number of 187,971 while the second position is taken by Chevrolet Volt with 155,477 car sales. The Tesla Model S comes third having sold 134,392 cars. Overall, Tesla is leading in the sale of electric cars in the U.S.

- Innovative Company

Across the automobile world, Tesla has the highest rate of innovation. For instance, recently, it manufactured the world’s first fully-electric semi-truck and a new sports car. As such, the market trusts and expects Tesla to manufacture competitive and profitable products that will eventually lead to significant financial gains.

- Cross-sell and Diversification

Tesla Company has launched a comprehensive insurance program for its automobiles in association with Liberty Mutual insurance. No other brand has done this, thus it is enticing for one to buy their products.

- Distribution channel

Tesla Motors understands the importance of a great distribution channel for their business model. It is for this reason that it has its distribution channel. Besides, there are capacity expansion plans from Tesla which has been occasioned by Giga production plant.

- Monopoly

Tesla motors were founded to target a very niche segment of electric cars and alternate energy cars. With this strategy, tesla has moved deeper to a point that it operates as a monopoly in the market. This has seen it gain quick growth compared to its competitors who have been in the automotive industry for ages.

Tesla’s Weaknesses;

Various internal factors that may cause damage or restrictions performance of the company are identified to be weaknesses. As such, in this SWOT analysis, we identify some of the weakness that Tesla Motors and have reduced its competitiveness in the automobile market as well as its business growth.

- Complications in Manufacturing Process

A higher innovation standard comes with greater mechanical complications and production risks. Tesla Motors faces frequent inauguration, manufacturing and production delays when it comes to launching their new vehicles and other products to the market. For instance, the company has faced endless manufacturing difficulties when it was launching Model X leading to several delays for its distribution. In the same manner, Tesla went through a lot of trouble while developing and manufacturing Model X’s battery module assembly line at Giga 1 plant.

- Failing to Meet Demand

The high experimenting and complicated procedures of production in Tesla Motors might lead the company into unbalanced supply and demand thus unable to meet its production requirement. For instance, their delivery rate in the 1st quarter of 2019 is worrying. Tesla has so far delivered 63,000 cars in the 1st quarter representing a 31% drop from the last quarter of 2018. Besides, Tesla manufactures its car models in one operational plant that is located in Fremont, California. With only one manufacturing plant, it has become difficult for the company to meet high production volumes.

- Lack of High Volume Production

Even though Tesla is the pioneer of alternative energy and electric cars, it has failed to produce meet high production volumes of cars for any of its models. As the company prepares to roll out high production for Model 3 vehicles, it still faces challenges in terms of production and management of resources, not to mention the space doe expansion at its Gigafactory 1.

- Shortage of Batteries

The limited supply of batteries has been a major drawback at increasing the production rate of Tesla automobiles. The shortage of batteries has, in turn, affected the sales of electric vehicles and energy storage systems.

- Poor Liquidity

When compared to competitors like General Motors, Ford or Fiat Chrysler motor companies which are financially rich form many years of operations, Tesla has only USD 3 billion which is not enough for it to effectively run its operations. Poor liquidity thus affects Tesla’s entire operations.

- Poor Customer Awareness

Even though Tesla manufactures exclusive products that are essential for the environment thanks to their sustainability angle, these products are extremely futuristic and most customers are still in the dark on whether to invest in Tesla products that tend to be expensive as well. Lack of proper marketing strategy of Tesla automobiles has significantly affected their sales. If more people get to know the importance of driving an electric car, more people will buy them.

- Limited Market Presence

Tesla Motors greatly suffers from limited market presence since it only generates most of its revenues in the U.S where it is dominant with little presence in China and the other countries. This is one of the main weaknesses that hinder the company’s growth and expansion to other markets like in the developing world.

- High Prices

Tesla products are quite expensive compared to other car brands in the market, especially those that come with internal combustion engines. The high price of Tesla cars prevents it from expanding its customer base and market share faster like its competitors.

- Burning Cash with no profit in view

Since its inception in 2003, Tesla has never made profits yet it continues to burn through an increased amount of cash. The company made USD 11.76 billion in revenue in 2017, but it had a net loss of USD 2.24 billion for the same period. In the 1st quarter of 2018 alone, the company burned USD 745.3 million in cash and posted a record net loss of USD 710 million. How Tesla is making huge loses is alarming and this is significantly affecting investors and the company’s share prices as well.

The weaknesses recognized in this SWOT analysis shows that Tesla needs to reform its strategies related to global expansion, growth, marketing among others so that the company can extend its products to new markets while maintaining its customer bases.

Tesla’s Opportunities;

This section of this SWOT analysis emphasizes the emerging chances of growth for Tesla Motors. Opportunities are external factors which when identified can significantly help Tesla improve its business performance, management structure and overall strategic growth among other aspects. These are some of the opportunities that Tesla Motors should consider capitalizing on to improve its performance in the competitive motor manufacturing environment.

- Sales Expansion in Untapped Market

This is one of the most significant opportunities for Tesla Motors to expand the expansion of its sales to untapped markets like in Asia where the market is still unsaturated in the field of electric and alternative energy automotive. It can also consider expanding to the developing world in Africa and Latin America to increase its financial muscles and a stronger market presence.

- Affordable Car Models

As we found out, Tesla cars are way expensive due to its unconventional dependence on innovation which in turn requires maximum financial support to entertain innovative technology. Tesla recently inaugurated Model 3, which is said to be more affordable. But this can be seen as an excellent opportunity for Tesla to expand the size of their audience market.

- Introduce Battery Production technology in-house

Tesla is slow trying to manufacture its battery cells and this is a big strategy that will help it increase its production rate while reducing its production cost. However, Panasonic remains its primary supplier of batteries.

- Diversification

Diversification can greatly improve Tesla’s performance. The aspect of diversification involves the establishment or putting up new businesses to dampen business exposure to risks in the automotive market. As such, Tesla ought to grab this opportunity so that it cushions itself from frequent losses in its automobile sales.

Tesla’s Threats;

Threats are factors that combine to hinder the organization from taking full advantage of benefits that can be gotten from various strengths. Tesla Motors faces various threats that have affected its ability to maintain their business even with the unpredictable market forces. These are some of the threats that Tesla faces:

- Product Liability Claims

Tesla promises premium quality assurance and high standards of manufacturing in the automobile industry, nonetheless, it frequently faces a significant product liability claim which is the biggest financial blows to the company. Even though it launched several autopilot cars, not all of them have been successful in accident cases. As such, the company has faced claims and lawsuits related to technological failure in their vehicles. If this trend continues, the company may be exposed to greater financial drawbacks.

- Competition

Tesla Motors faces extensive competition from both self-driving technology and alternative energy vehicles like electric, hybrid, and plug-in hybrid cars. Various luxury brands like BMW, Lexus, Mercedes, Audi and the economy brands like Ford, GM, and Toyota have put up a fierce competition. Although they are not manufacturing environment-friendly brands of their own, they offer their products at a much lower price than Tesla. This is a threat for Tesla that thrives on its unique value for innovative vehicles that are way expensive for most people.

- Product Defects

Tesla’s manufacturing process is way too complex for its innovative vehicles. As such, most of its vehicles have exhibited major defects. The flawed products in most cases show weakness in design, manufacturing and other features. This has dealt a heavy blow to Tesla’s image.

- Long term confidence

The guarantee of long term sustainability for any company is an important aspect of maintaining the public image and the company’s optimism. Owing to the unsteady manufacturing conditions in Tesla Motors, the company suffers from disbelief among the customers about its long-term existence. As such, it has resulted in slow business development and expansion.

- Shortage of Materials

Shortage of manufacturing materials is a major threat to Tesla’s manufacturing and distribution of its products. The shortage has often been occasioned by the high prices of these materials. Tesla uses materials such as steel, aluminium, copper, lithium, nickel, cobalt and lithium-ion cells from suppliers. These materials have fluctuating prices which often impact the company’s production line.

- Customer Acceptance

Any business operates along the lines of customer acceptance. If the customer is ready to embrace the company’s products, the company benefits from its wide range of innovative products. Nonetheless, customer acceptance can be a slow process and producing new innovative products like Tesla. Tesla Motors generally depends on the willingness of customers to adopt their electric vehicles.

- Dealership Regulations

Tesla faces a threat of dealership regulations. Presently, the company sells its products directly to customers without dealership involvement which in turn surges selling prices. Some of the U.S states like Texas and Virginia disallows direct sales of company products and requires that sales must go through dealerships.

- Lack of Self Driving Regulations

There are no proper regulations guiding self-driving in many countries across the world, including the U.S where Tesla is based. As such, Tesla’s sales are impacted by these regulations in many parts of the world. The legal complexity increases uncertainty about Tesla’s self-driving project’s future.

- Elon Musk’s Erratic Behavior

Tesla’s reputation is founded on the revolutionary personality of its CEO Elon Musk. However, his erratic behaviour and impulsive reactions have greatly impacted Tesla’s reputation as a beacon of the innovative brand. His recent marijuana smoking incident on Joe Rogan’s podcast created a major controversy for being inept. This incident saw Tesla’s stock value drop close to 9 per cent.

Conclusion

Tesla Motors is an innovative automobile company that is optimistic in transforming the future of driving. Not only is it focused on manufacturing eco-friendly luxurious cars for the upper-class citizens but also making steps towards developing self-driving cars.

However, a few factors stand in the way of Tesla’s ambition. The company spends millions of dollars in research and development since its inception almost 20 years ago. Certainly, this is the cost of being a leader in the technological field. But, this action has led the company into millions of debts which it is still struggling to pay off. Despite the weaknesses and threats that Tesla faces, the company is still the ultimate symbol of innovation in the automobile industry and needs to take actions to expand its market share and financial stability.

Also read: Apple SWOT Analysis

great post, very informative. I ponder why the other experts of this sector don’t realize this. You should continue your writing. I’m sure, you have a great readers’ base already!

We always love it when a reader leaves a comment on our articles. More content is coming. How about you read the other articles and give us some feedback…

Nice